ON CORPORATE FINANCE & MACROECONOMICS

Publications

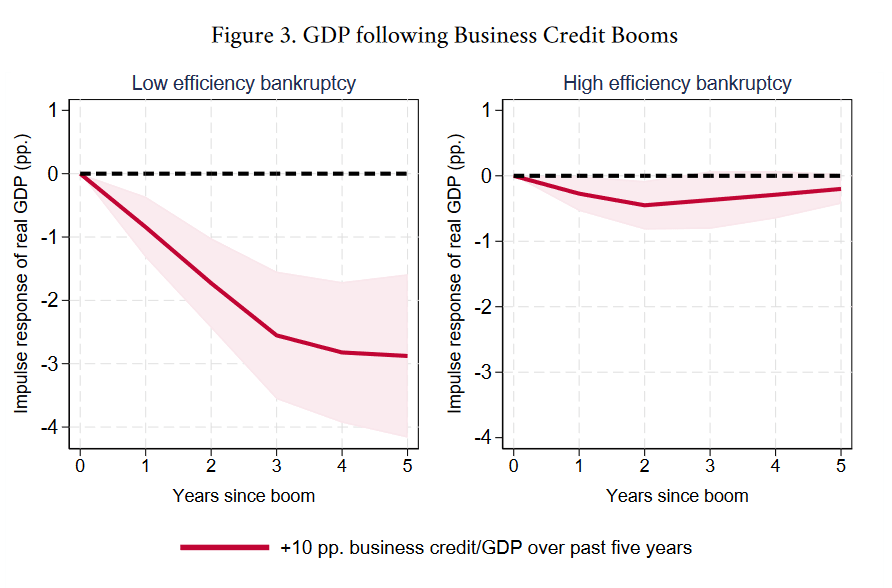

Bankruptcy Resolution and Credit Cycles

with Chen Lian, Yueran Ma, Pablo Ottonello and Diego Perez

We study how the macroeconomic implications of credit cycles vary with business bankruptcy institutions. Using data on bankruptcy efficiency and business credit across countries, we document that business credit booms are followed by severe declines in output, investment, and consumption in environments with poorly functioning business bankruptcy. On the contrary, in settings with well functioning business bankruptcy, the aftermath of credit booms is characterized by moderate changes in economic activities. We use a simple model to lay out how and when efficient bankruptcy systems can mitigate the negative consequences of credit booms.

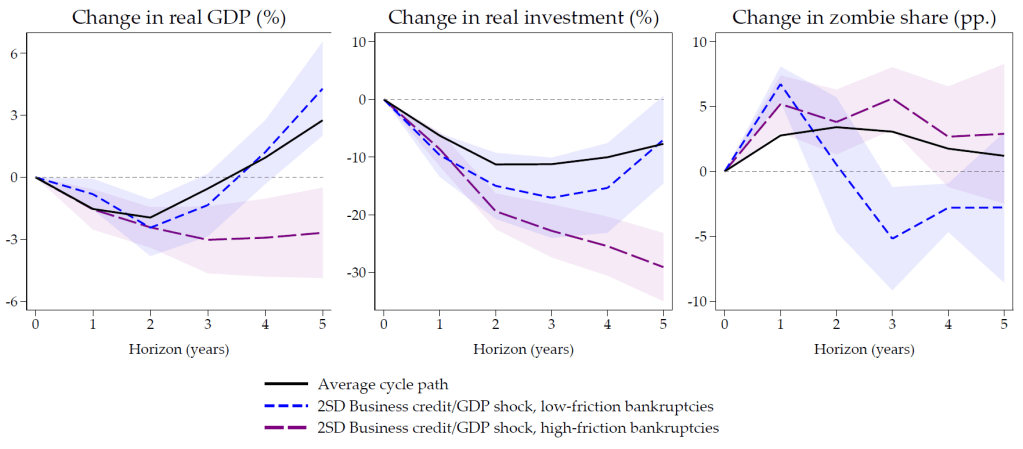

Zombies at Large? Corporate Debt Overhang and the Macroeconomy

with Òscar Jordà, Moritz Schularick and Alan Taylor

Debt overhang is associated with higher financial fragility and slower recovery from recession. However, while household credit booms have been extensively documented to have this property, we find that corporate debt does not fit the same pattern. Newly collected data on non-financial business liabilities for 18 advanced economies over the past 150 years shows that, in the aggregate, greater frictions in corporate debt resolution make for slower recoveries, with weak investment and more persistent „zombie firms“ and that this is an important factor in explaining the difference in outcomes relative to household credit booms.

Working Papers

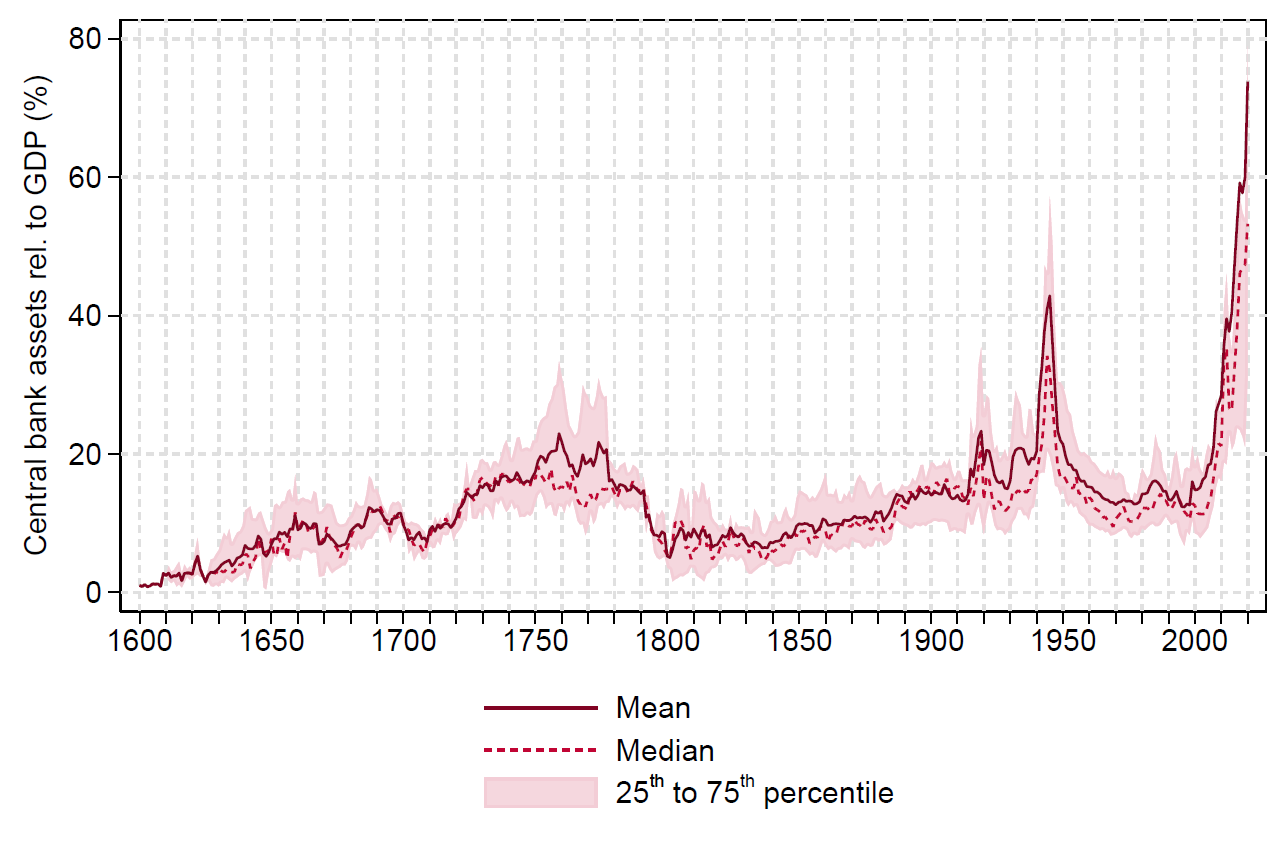

The Safety Net: Central Bank Balance Sheets and Financial Crises

with Niall Ferguson, Paul Schmelzing and Moritz Schularick

This paper studies the evolution of central bank balance sheets over the past 400 years across 17 major economies. The size of central bank balance sheets has varied substantially over time relative to economic and financial activity. Major balance sheet expansions were initially associated with government finance in geopolitical emergencies, but over time liquidity provision during financial turmoil has become the key driver of balance sheet operations. We examine the historical record of such lender of last resort interventions with a novel identification strategy based on pre-determined ideological beliefs of acting central bank governors (“hawks” vs. “doves”) with respect to financial sector support. Using exogenous variation in the crisis response, we estimate the effects of lender of last resort operations on the economy. History shows that liquidity support during financial crises has indeed tended to stabilize the economy successfully: crises are less severe, asset prices recover more quickly, and deflation is avoided. However, there is also evidence that the provision of central bank liquidity to financial markets raises the probability of future boom-bust episodes, pointing to potential moral hazard effects of central bank intervention.

Revise and Resubmit at Journal of Political Economy

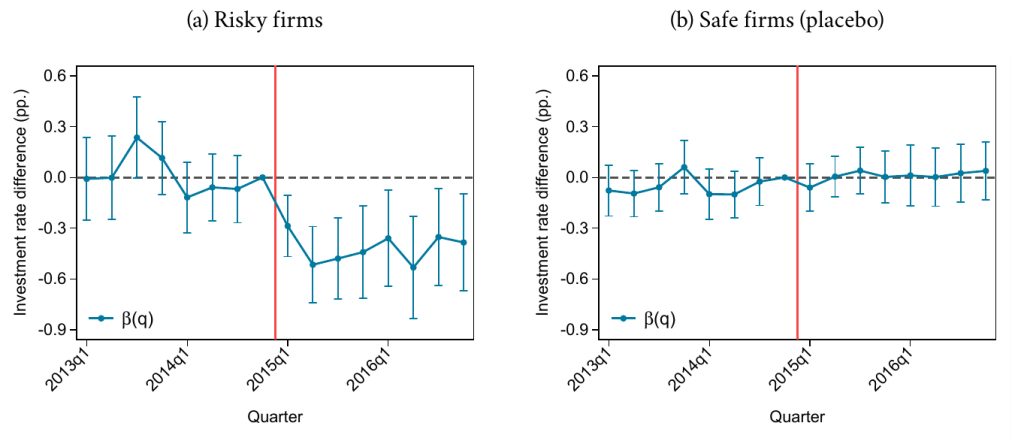

Market Creditor Protection, Finance and Investment

In contrast to traditional bank lending, bond market debt disperses the creditor base. Legal protections of dispersed market creditors can exacerbate coordination frictions and raise the cost of default. I show that market creditor protection can thus be excessive, discourage market-based lending and reduce firm investment in theory. I estimate the effects of a US court ruling which protected bond market creditors from coercive exchange offers: The ruling forced distressed firms to restructure bond market debt more frequently in costly court procedures. Healthy firms responded by cutting bond issuance and investment. Direction and magnitude of reactions indicate that over-protecting dispersed creditors can undermine public credit markets, with adverse real effects.

Work in Progress (selected)

Creditor Rights and Credit Cycles

with Shohini Kundu and Karsten Müller

We empirically investigate how legal protection of creditor interests shape the economic cycle. In a first step, we establish basic facts about credit cycles in countries with strong creditor rights compared to countries with weak creditor rights. In the second step, we formulate hypotheses consistent with those macroeconomic facts and test them in microeconomic data using more stringent identification strategies.

Macroeconomics of Public Capital Markets

with Moritz May

Public capital markets intermediate savings without the frictions of traditional banking. This has long inspired European policy initiatives to promote capital markets. Yet, the US financial systems appears to increasingly de-emphasize the role of public corporate financing. Guided by empirical evidence, we design a general equilibrium model with nontrivial financial architecture to investigate the macroeconomic role and determinants of public capital markets.

ON OTHER Topics

Publications

Pandemic Consumption

with Rüdiger Bachmann and Christian Bayer

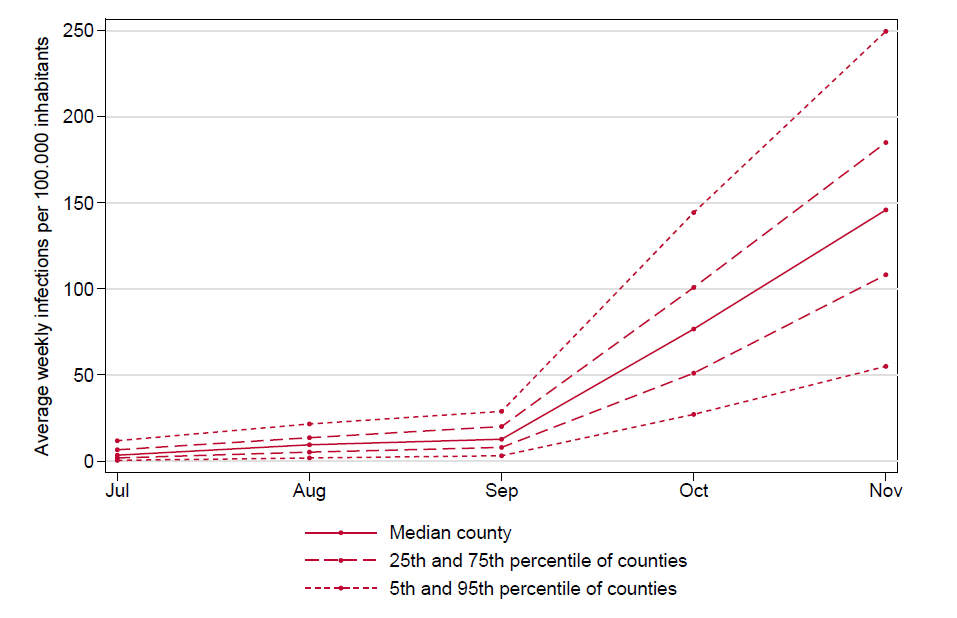

This paper examines how households adjusted their consumption behavior in response to COVID-19 infection risk during the early phase of the pandemic. We use a monthly consumption survey specifically designed by the German Statistical Office covering the second wave of COVID-19 infections from September to November 2020. Households reduced their consumption expenditures on durables and social activities by, respectively, 24 percent and 36 percent in response to one hundred extra infections per one hundred thousand inhabitants per week. The effect was concentrated among the elderly, whose mortality risk from COVID-19 infection was arguably the highest.

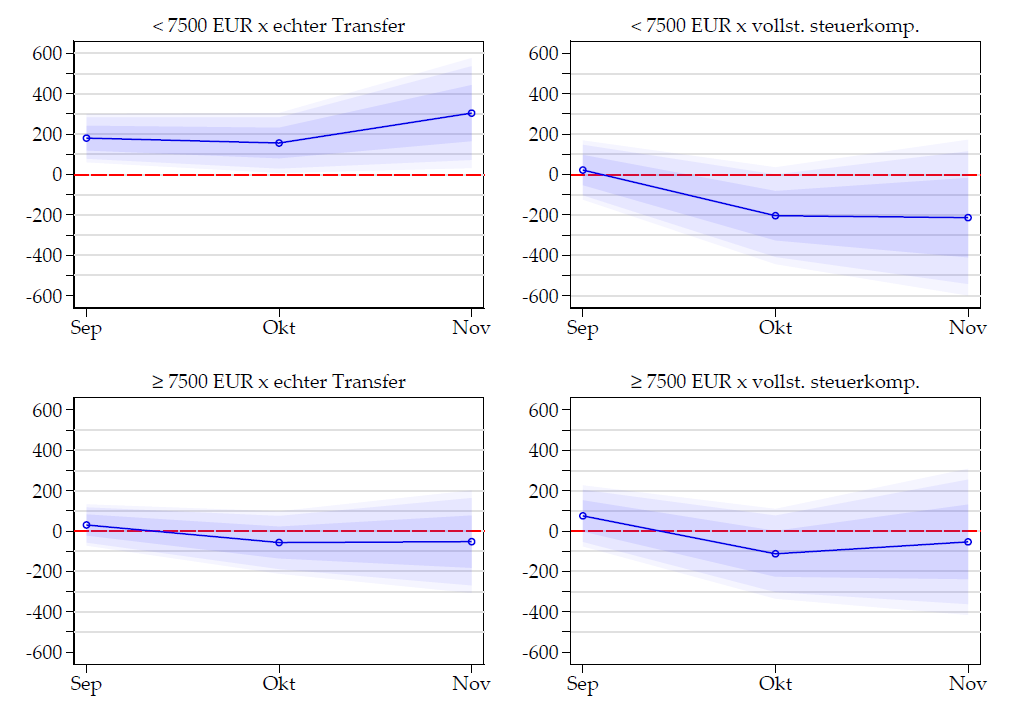

Kinderbonuskonsum

with Rüdiger Bachmann and Christian Bayer

To fight the pandemic recession of 2020 and alleviate socio-economic repercussions, the German government targeted transfers at families. We evaluate the policy’s consumption multiplier at the micro-level using representative data from a survey designed for that purpose. We document heterogeneity across families with different economic characteristics. The aggregate consumption multiplier might have been as large as 30% cumulated over three months. Our estimates cast doubt upon the reliability of households‘ self-reported consumption impulses, pointing to mental accounting biases. (Article in German)

Working Papers

Work in progress

Monetary Policy, House Prices and Regional Discount Rates

with Francisco Amaral, Steffen Zetzmann and Jonas Zdrzalek

This paper investigates the heterogeneous impact of monetary policy on house prices across geographical regions. We document substantial spatial heterogeneity in the sensitivity of house prices to monetary policy shocks. In large superstar agglomerations with low rental yields, prices decline (rise) more strongly in response to contractionary (expansionary) monetary policy compared to peripheral regions with high rental yields. We propose a mechanism based on pre-existing differences in regional discount rates for real estate assets.